salt tax cap married filing jointly

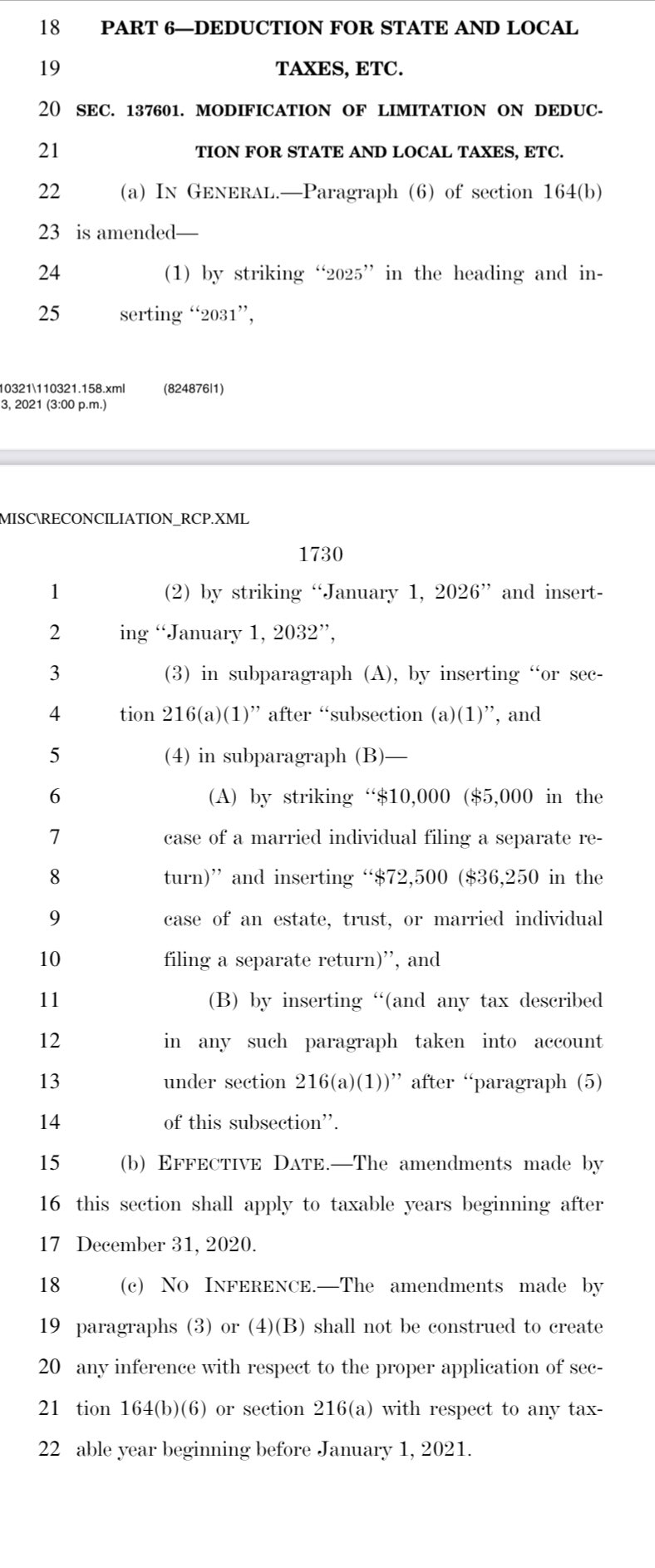

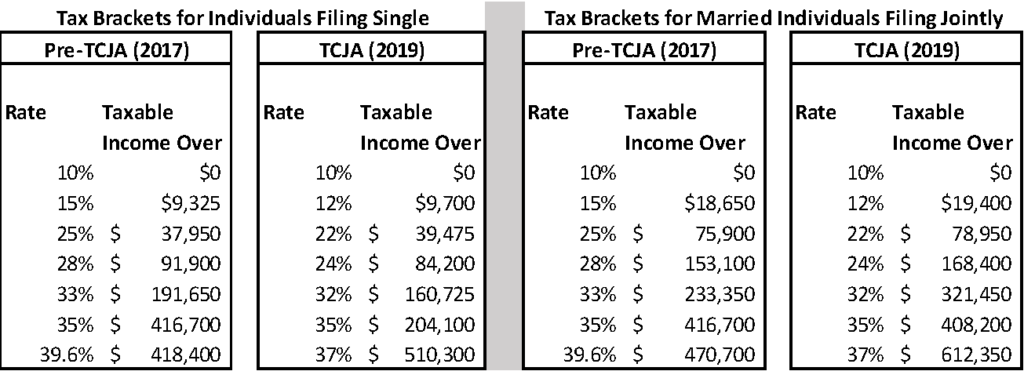

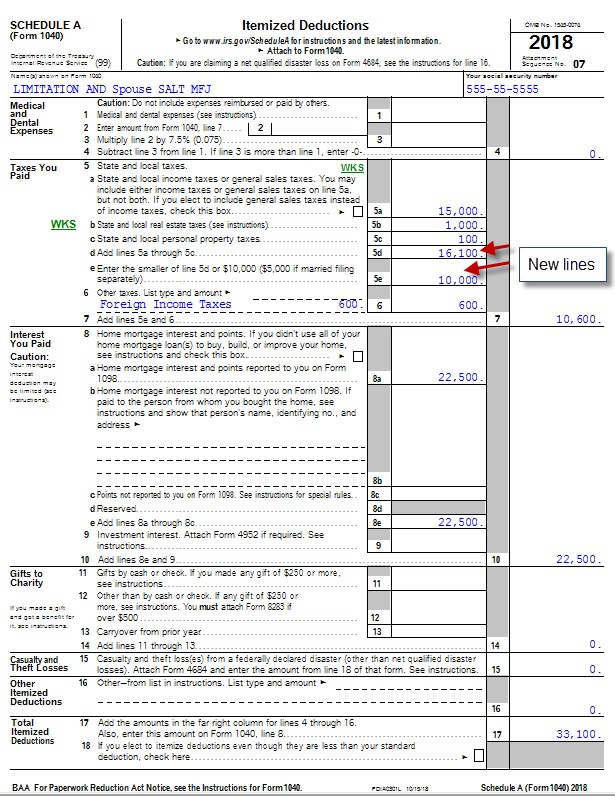

Under TCJA the SALT deduction was capped at 10000 for single filers and married couples filing jointly. New tax law for 2018.

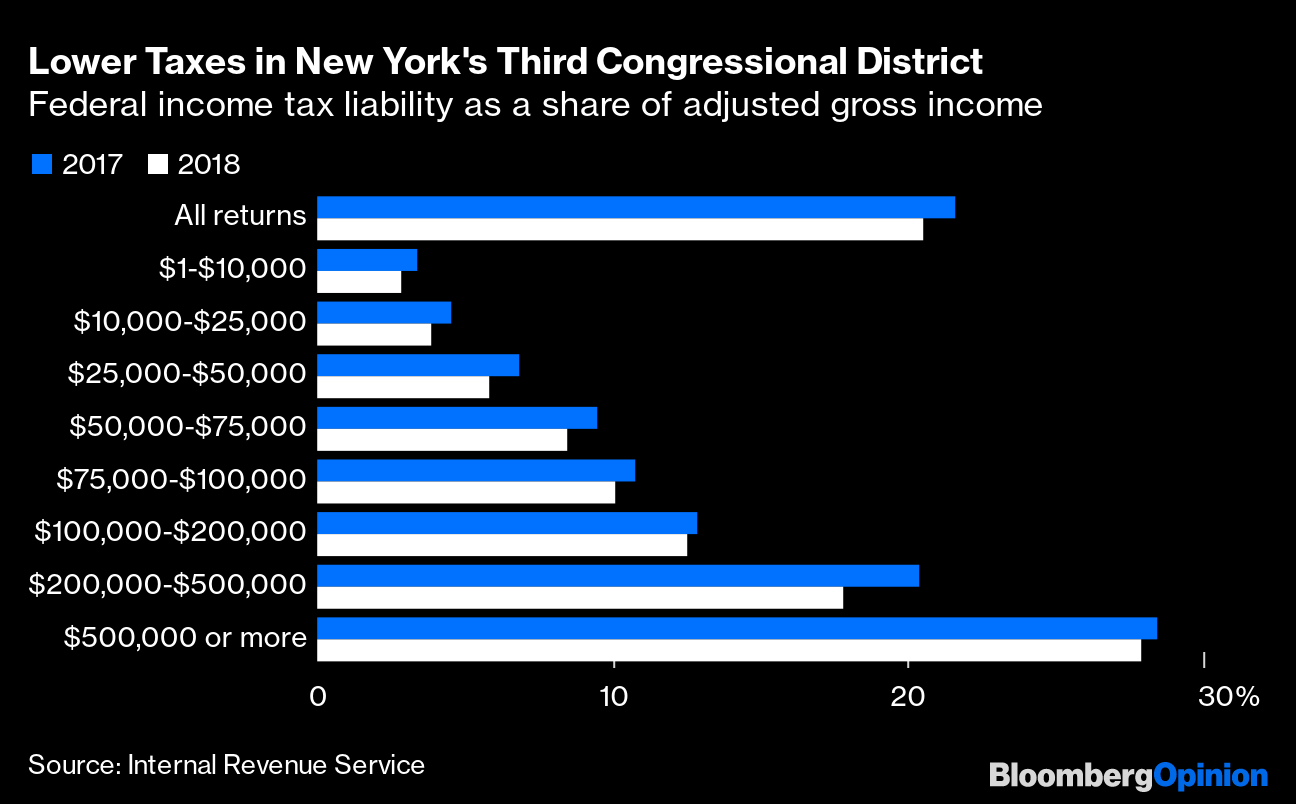

Salt Deduction Limits Aren T So Bad For The Middle Class Bloomberg

The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately.

. Head of household filers and married taxpayers filing jointly. The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. However for tax years 2018 through 2025 the TCJA capped the SALT deduction at 10000 for single taxpayers and couples filing jointly limiting its value for tax filers.

Accordingly the taxpayers 2018 SALT deduction would still have been 10000 even if it had been figured based on the actual 6250 state and local income tax liability for. For married taxpayers filing separately the cap is 5000. It is 5000 for married taxpayers filing separately.

52 rows The deduction has a cap of 5000 if your filing status is married filing. Under TCJA the SALT deduction was capped at 10000 for single filers and married couples filing jointly. Is it 5000 for Married Filing Separately.

The arrival of the TCJA meant that the standard deduction amount was increased which reduced the number of taxpayers eligible to have deductions and capped the overall SALT deduction at. The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. Is it 5000 for Married Filing Separately.

The arrival of the TCJA meant that the. Under TCJA the SALT deduction was capped at 10000 for single filers and married couples filing jointly. If you paid 5000.

Under tcja the salt deduction was. The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. The federal tax reform law passed on Dec.

It is 10000 for all other filing statuses. Hello Its my first time filing a joint return for 2019 year. June 6 2019 620 AM.

By limiting the SALT deduction. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. My partner and I each received 1099gs in a high tax state.

The measure dubbed the Restoring Tax. If you are a person with a single filing status taking the largest possible amount for your SALT deduction at 10000 the total amount of the rest of your itemized deductions would need to. Trying to figure out how much of our 2018 state refund.

In the 2017 Tax Cuts and Jobs Act the federal government enacted a. By limiting the SALT deduction available to. The measure dubbed the Restoring Tax Fairness for States and Localities Act or HR 5377 proposes increasing the so-called SALT cap to 20000 for married taxpayers who.

The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. T he state and local tax SALT. Married couples filing jointly.

The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. As a side note it is a 10000 limit for the combined.

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

:max_bytes(150000):strip_icc()/state-income-tax-deduction-3192840_FINAL_v3-42fac1f5ce444c9a8a317c9a598e8084.png)

The State And Local Income Tax Deduction On Federal Taxes

Legislation Introduced In U S House To Restore The Salt Deduction

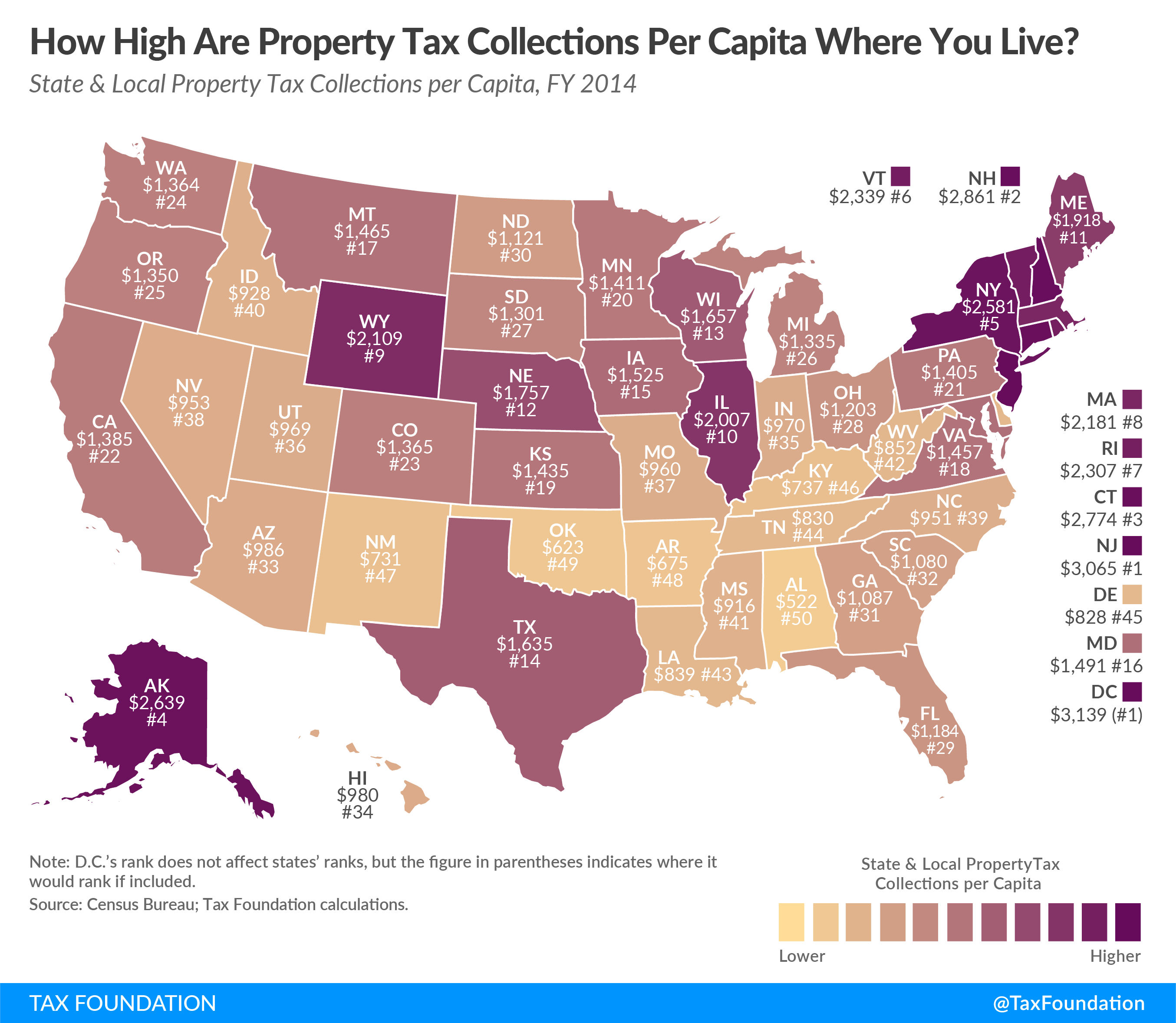

The Gop S 10 000 Cap On Property Tax Deductions And How It Affects One Congressional District The Washington Post

Married In 2022 See 10 Benefits Of Filing Jointly On Your Taxes

Salt Deduction Limits Aren T So Bad For The Middle Class Bloomberg

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People Tax Policy Center

Blue States File Appeal In Legal Battle Over Salt Tax Deductions

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The New Year Is In Full Swing Know Your Limits And Get Ready To File Sensible Financial Planning

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Salt And The Marriage Penalty Merrick Today

How Does The Deduction For State And Local Taxes Work Tax Policy Center

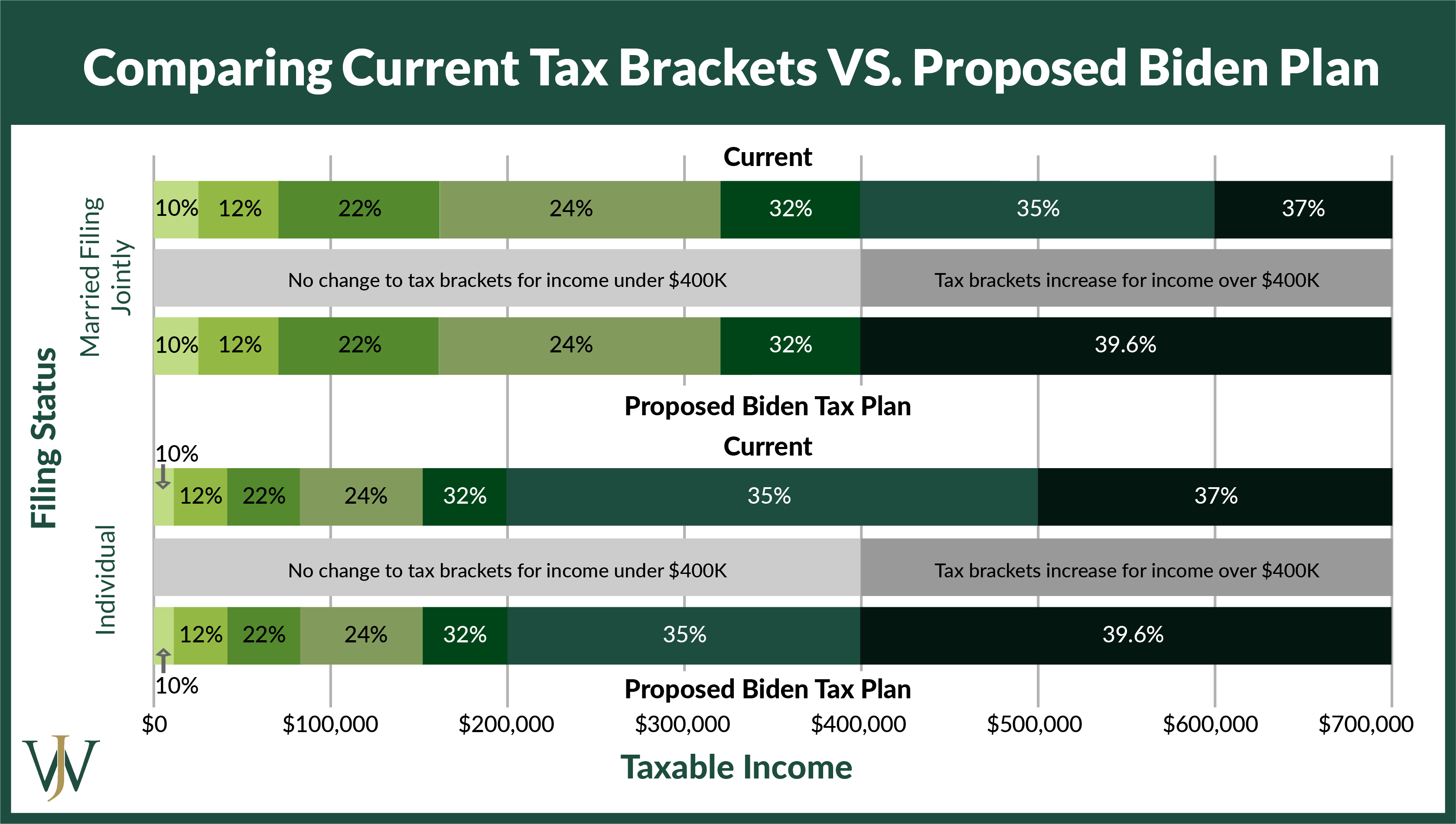

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How Tax Brackets Work 2023 Tax Brackets White Coat Investor

How Tax Reform Affects The State And Local Tax Salt Deduction Tax Pro Center Intuit